FIN358 Fixed Income and Derivative Securities TMA Assignment, SUSS, Singapore Sand is an important raw material used in the construction of buildings, roads, and the manufacture of glass

| University | Singapore University of Social Science (SUSS) |

| Subject | FIN358: Fixed Income and Derivative Securities |

Question 1

(a) Sand is an important raw material used in the construction of buildings, roads, and the manufacture of glass. Despite its importance in the economy, there are no futures contracts for sand. Appraise the issue and briefly offer two (2) possible explanations.

(b) Mr. Rossi is the CFO of Starlight Corporation which manufactures light fittings. Its main market is the US. Mr. Rossi wanted to hedge his US dollar receipts.

(i) Discuss two (2) reasons why Mr. Rossi chose to use forward contracts instead of futures contracts.

(ii) Discuss one (1) reason why Mr. Rossi did not consider using swaps instead of futures contracts.

(c) (i) Discuss what the term “open interest” means.

(ii) Appraise the use of open interest by traders in the futures markets.

(iii) Explain how the open interest for a futures contract can remain the same even though there are transactions for the contract.

(d) (i) John Tan is a commodity trader. He observed the following prices in the

commodity market. Appraise whether there is an arbitrage opportunity, how he can execute it, and the profit that can be made.

Spot price of commodity = $50

Futures price of commodity = $52

1-year risk-free interest rate = 4%

1-year storage cost = 1%

(ii) Discuss two (2) obstacles in the market that prevents Mr. Tan from realizing the profit.

Question 2

(a) Discuss whether the following options will be exercised early.

(i) Dividend-paying call

(ii) Non-dividend paying put

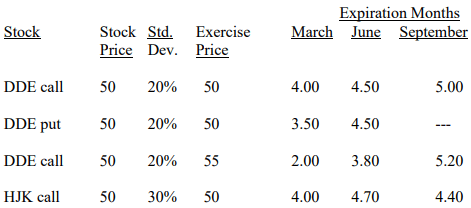

(b) You are an options trader for a hedge fund. Your assistant prepared the following sheet containing the prices of various options on January 31. Assume the options expire at the end of the expiration month. The risk-free interest rate is 8% per annum.

Appraise the options and identify three (3) pricing discrepancies. You may use the Excel program to help you uncover the pricing discrepancies. Show how you would profit from them.

Use the following format to answer this question.

• Pricing Discrepancy:

• Strategy to profit from pricing discrepancy:

(c) List two (2) limitations of using the Black-Scholes model for valuing options.

- CH2123 Assignment: Fugacity, VLE Modeling & Applications of Henry’s Law

- BAFI1045 Assignment -Constructing and Evaluating Passive and Active Portfolios Based on the Straits Times Index (STI)

- FIN2210E/FIN2212E Group Assignment: Financial Risk Management Analysis of Bursa Malaysia Companies

- FLM101 Assignment: A Film Analysis: Stylistic Techniques and Their Thematic Importance

- HRM Assignment Answer: Talent Transformation in the Age of AI: Turning Challenges into Opportunities via Ecosystem Innovation

- COMP 1105 Assignment: Health-Focused E-Commerce Website: A Web Technologies Project Using HTML5, CSS, and JavaScript

- Assignment Anwser: Machine Learning in Robo-Advisory Services: Evolution, Applications, and Future Trends

- OMGT2229 Assignment: Quantitative EOQ Analysis, and Strategic Sourcing Decisions for JB Hi-Fi

- Assignment 2 Anwser: Corporate Finance and Planning: An In-Depth Financial Analysis of Company

- BUSM4551 Assignment: The Role of Innovation in Advancing the UN Sustainable Development Goals (SDGs)

UP TO 15 % DISCOUNT