GSP110 ECA: Introduction to Personal Financial Planning

| University | Singapore University of Social Science (SUSS) |

| Subject | Introduction to Personal Financial Planning |

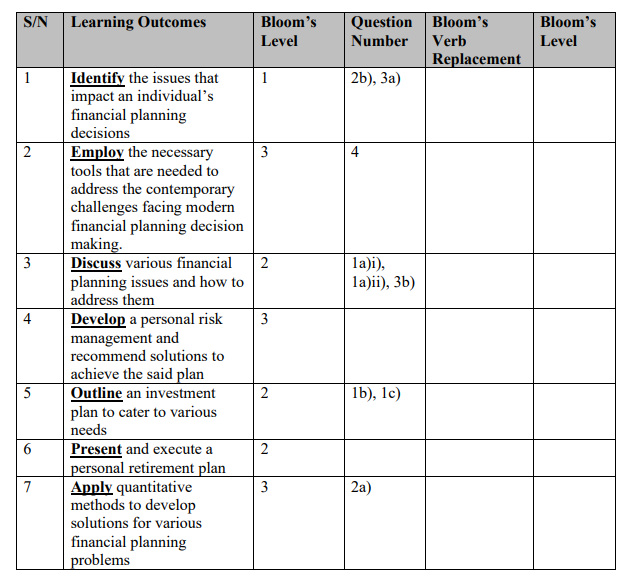

Learning Outcomes

Additional instructions:

• You will need to indicate clearly on the front page your name, student ID, course title and assignment number.

• Summarise using your own words as much as possible. You must document all information that you use from another source, or you will be penalized severely. You must acknowledge these by using the APA documentation style.

This includes both intext citations and end-of-text referencing.

• Backup your ECA at all times.

• Strictly follow the naming convention specified for ECA files.

• Submit early and check the Turnitin originality report for possible revision and resubmission. Turnitin reports are generated immediately the first time, but subsequent reports may take up to a day to generate.

• You are allowed multiple submissions to Turnitin before the deadline. After the deadline, only one submission is allowed, and only if you have not already made a prior submission.

• Upload the correct ECA file to the correct folder of the correct course. An admin fee applies to appeals to transfer files to the correct folder.

• The 12-hour grace period after the deadline is NOT an extended deadline but is solely for resolving any technical problems encountered with submissions before the deadline.

• Automatic mark deduction applies after the 12-hour grace period (refer to the mark deduction scheme in the Student Handbook).

• Retain the Turnitin digital receipt as evidence of a successful submission. Appeals submitted without the Turnitin digital receipt will not be entertained.

• View your submission immediately to ensure that the entire document has been uploaded completely and successfully.

• If you fail to submit your End-of-Course Assessment, you will be deemed to have withdrawn from the course.

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Question 1

a) Many investors experience all kinds of biases what will affect how they select and manage their investment portfolio. Discuss what the following biases are, and how they can negatively impact your investments

i) Overconfidence Bias

ii) Regret Aversion Bias (Total 12 marks)

b) When investing, you will frequently experience risks. Outline what is risk in terms of investment returns. (Total 5 marks)

c) Outline the significance of a fully diversified portfolio in terms of risk.

(Total 8 marks)

Question 2

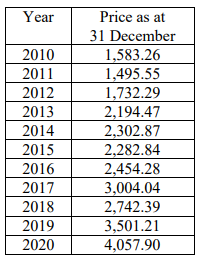

When deciding whether to invest in Carnival Technologies, Melvin collated the stock prices of the company:

a) Apply the correct processes to determine the Arithmetic and Geometric Mean of the investment for the last 10 years. (use the product method to calculate your GM) (20 marks)

b) Identify the difference between Passive and Active managed funds. (5 marks)

Question 3

Read the attached Straits Times article published on 21 January 2025 entitled “Why Bitcoin and gold can have a place in portfolios”, and consider the following question.

a) It is mentioned that Bitcoin and gold share similarities. Identify from the article what these similarities are. (Total 9 marks)

b) Discuss how gold is in many ways superior to Bitcoin.

(Total 12 marks)

c) In the last sentence of the first column of the article, the head of the World Gold Council for the Asia-Pacific region regards Bitcoin and gold as being alternatives to fiat currencies. Explain what a “fiat” currency is. (please use the internet to search for your answer) (Total 4 marks)

Question 4

Vincent and Marie have been happily married. Together, they have 2 grown children who are gainfully employed and no longer in need of financial support. Vincent is now 50 years old, and Marie 48.

After working for 25 years, Vincent feels he will be ready to retire when he is 60 years old. From a recent article he read in a scientific journal, he has ascertained that the local average mortality of a man would be about 81 years old, and a woman about 85 years old.

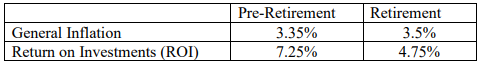

If Vincent and Marie would each need $2,500 a month in today’s dollars to retire, employ the correct tools to ascertain how much Vincent would need to set aside when he retires for the both of them to be able to retire up to their respective ages of average mortality.

Use the following additional assumptions for the question:

Buy Custom Answer of This Assessment & Raise Your Grades

- Final Assignment: Migrating FashionOnline’s Infrastructure to AWS: A Strategy for Enhanced Availability and Data Protection

- HRM331: Talent Management – Strategic Shift from the War for Talent to the Wealth of Talent

- Marginalised Populations – The Structural and Cultural Exclusion of People Experiencing Homelessness in Singapore

- CVEN3501 Assignment 2: Groundwater Modelling of Drawdown from a Pumping Bore

- CSCI312 Assignment 2: Conceptual Modelling and Implementation of a Data Warehouse and Hive Queries

- CH2123 Assignment: Fugacity, VLE Modeling & Applications of Henry’s Law

- BAFI1045 Assignment -Constructing and Evaluating Passive and Active Portfolios Based on the Straits Times Index (STI)

- FIN2210E/FIN2212E Group Assignment: Financial Risk Management Analysis of Bursa Malaysia Companies

- FLM101 Assignment: A Film Analysis: Stylistic Techniques and Their Thematic Importance

- HRM Assignment Answer: Talent Transformation in the Age of AI: Turning Challenges into Opportunities via Ecosystem Innovation

UP TO 15 % DISCOUNT