BUS303 Team Project Question: Tax Liability Assessment for Miss Duck Hollow

| University | Singapore University of Social Science (SUSS) |

| Subject | Business Communication |

Miss Duck Hollow has approached your team of tax experts for information related to her tax liabilities. The facts related to her case are presented below:

Miss Duck Hollow operated a business solely involved in winemaking in the Hunter Valley. She commenced this business on 11 November 1984. She held a 40-year contract (known as the ‘wine contract’) with a UK company, Zed Co, to supply it with 400,000 bottles of wine per annum at $10 per bottle, indexed with inflation. The wine contract commenced on 11 November 1984.

On 1 July of the current income tax year, she transferred her rights under the wine contract to Pyramid Pty Ltd for a quarterly cash payment. The quarterly cash payment was based on 10 per cent of the sales value of the wine supplied to Zed Co by Pyramid Pty Ltd under the wine contract. During the current tax year, she received four payments totalling $500,000 (excluding GST) from Pyramid Pty Ltd under this arrangement.

On 31 December of the current income tax year, she sold her business goodwill to Acme Pty Ltd for $5,000,000 (excluding GST). On 31 December, she also sold her trading stock to Acme Pty Ltd for $600,000

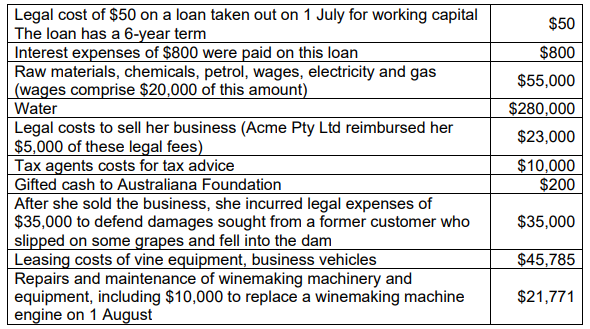

(excluding GST). Other wine sales to 31 December (when she ceased business) were $1,600,000 (excluding GST). During the current income tax year ended 30 June, she paid out the following gross expenses:

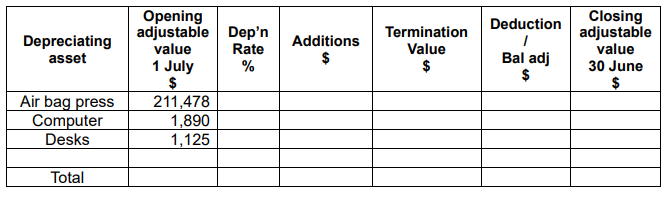

Her depreciation schedule for the current year ended 30 June is set out below.

All assets have 100 per cent business use and were acquired after 1 January 2000 and before 10 May 2006. She uses the diminishing value method.

On 31 December of the current income tax year, she sold all of the winemaking

machinery to Acme Pty Ltd for $200,000 (excluding GST). Also, on 31 December, she kept the desks for private use (market value of these items was $500). On the same date, she scrapped her computer. Use the Commissioner’s effective life.

You are required to prepare a report to Miss Duck Hollow providing the

following information which is of interest to her:

1. A statement of assessable income and deductions to calculate Miss Duck

Hollow’s taxable income for the income tax year ended 30 June

2. Reasons for the amounts included/excluded from assessable income in

your assessable income and deductions statement — provide justification using Sections, cases, commentaries and ATO rulings where applicable (Note:

Provide headings for each item)

3. Reasons for the amounts included/excluded from deductions in your

assessable income and deductions statement — provide justification

using Sections, cases, commentaries and ATO rulings where applicable

(Note: Provide headings for each item)

4. A depreciation schedule for the income tax year ended 30 June

5. Reasons for the amounts included/excluded from the depreciation

schedule — provide justification using Sections, cases, commentaries

and ATO rulings where applicable. (Note: Provide headings for each item.)

6. A statement using two examples to illustrate how taxation can be used to

promote sustainability.

Instructions:

The report should at a minimum comprise of the following:

a. An executive summary that conveys the overall purpose, problems and solutions to the case.

b. An introduction that clearly outlines the report structure, processes and

strategies adopted by the team in solving the case.

c. The main body of the report that responds to the information needs of Miss Duck Hollow

d. A conclusion

NB: Students should refer to the marking rubric for guidance on the specific

expectations for the assessment.

Formatting Requirements:

Font type: Times New Roman

Font size: 12

Spacing: 1.5 spacing

Word Count: Maximum of 2,000 words excluding references and appendices

Buy Custom Answer of This Assessment & Raise Your Grades

- Final Assignment: Migrating FashionOnline’s Infrastructure to AWS: A Strategy for Enhanced Availability and Data Protection

- HRM331: Talent Management – Strategic Shift from the War for Talent to the Wealth of Talent

- Marginalised Populations – The Structural and Cultural Exclusion of People Experiencing Homelessness in Singapore

- CVEN3501 Assignment 2: Groundwater Modelling of Drawdown from a Pumping Bore

- CSCI312 Assignment 2: Conceptual Modelling and Implementation of a Data Warehouse and Hive Queries

- CH2123 Assignment: Fugacity, VLE Modeling & Applications of Henry’s Law

- BAFI1045 Assignment -Constructing and Evaluating Passive and Active Portfolios Based on the Straits Times Index (STI)

- FIN2210E/FIN2212E Group Assignment: Financial Risk Management Analysis of Bursa Malaysia Companies

- FLM101 Assignment: A Film Analysis: Stylistic Techniques and Their Thematic Importance

- HRM Assignment Answer: Talent Transformation in the Age of AI: Turning Challenges into Opportunities via Ecosystem Innovation

UP TO 15 % DISCOUNT