ACFI2012 Assignment: Accounting for Corporate Entities T1 2025 (NBS)

| University | Newcastle Business School (NBS) |

| Subject | Accounting for Corporate Entities |

Individual Writing Assignment

Weighting: Worth 20% of final mark Marked out of 100

Due: Week 10 – 11.59pm Sunday, 23rd March 2025 (Singaporean time).

Total 100%, worth 20% of final mark.

Submission: via Canvas.

Your assignment MUST be submitted in ONE Word document (no Excel, PDF, or any other form), addressing all requirements of this assignment, otherwise your presentation will be penalised and your assignment may not be marked.

Turnitin reports can be used as evidence by the lecturer in the event that plagiarism is suspected in an assignment. Suspected acts of plagiarism will be forwarded to the Student Academic Conduct OƯicer (SACO).

Any assignment submitted late will be penalised at a rate of 10% per day of the possible maximum mark for the assignment for each day or part day that the assessment is late. Any assignment submitted more than five days after the due date will be awarded zero marks.

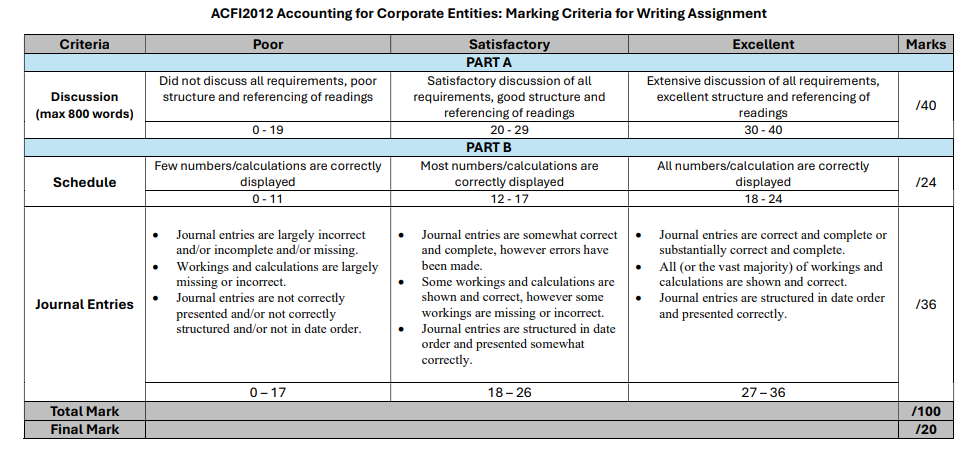

Please refer to the attached marking criteria (at the end of this document) to guide your work.

Part A: Essay (40 marks)

In their article entitled ‘U.S. firms challenged to get “intangibles” on the books’, Byrnes and Aubin (2011) noted that in the United States some companies were accounting for intangibles such as brands, patents and information technology diƯerently when they were developed internally rather than being acquired. This could mean major diƯerences in accounting numbersn where internally generated intangibles developed at low costs by one company were sold for

large amounts to another company. They noted: The accounting diƯerence could result in distorted behaviour, warns Abraham BriloƯ, a professor emeritus of accountancy at Baruch College, tempting companies to buy intellectual property rather than doing research themselves

Required

1. Explain the accounting for internally generated intangible assets in AASB 138/IAS 38.

2. Discuss any diƯerences between accounting for internally generated intangible assets and acquired intangible assets in AASB 138/IAS 38.

3. Discuss why shareholders and lenders may be reluctant to press for changes in AASB 138/IAS 38 to require more recognition of internally generated intangible assets.

4. Explain why managers of organisations would prefer changes in AASB 138/IAS 38 to require more recognition of internally generated intangible assets.

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Part B: (60 marks)

On 1 August 2024, Severus Ltd issued a prospectus inviting applications for 400 000 ordinary shares to the public at an issue price of $6.00, payable as follows:

$2.00 on application (due by closing date of 1 November 2024)

$2.50 on allotment (due 1 December 2024)

$1.50 on future call/calls to be determined by the directors

By 1 November, applications had been received for 430 000 ordinary shares of which applicants for 50 000 shares forwarded the full $6.00 per share, applicants for 150 000 shares forwarded $4.50 per share and the remainder forwarded only the application money.

At a directors’ meeting on 7 November, it was decided to allot shares in full to applicants who had paid the $6.00 or $4.50 on application, to reject applications for 10 000 shares and to proportionally allocate shares to all remaining applicants. According to the company’s constitution, all surplus money from application can be transferred to Allotment and/or Call accounts.

Share issue costs of $20 000 were also paid on 7 November. All outstanding allotment money was received by the due date.

A first call for $0.80 was made on 1 February 2025 with money due by 1 March. All money was received by the due date. A second and final call for $0.70 was made on 1 June with money due by 18 June. All money was received by the due date.

Required:

a) Prepare a schedule that shows the numbers of shares applied for, numbers of shares allotted, total cash received, cash received that relates to application, cash received that relates to allotment, cash received that relates to calls, cash refunded. (24 marks)

b) Prepare journal entries to reflect all transactions for the year end 30 June 2025. (36 marks)

Note: the entries should be displayed in date order of the underlying transaction. The detailed calculations and relevant description should be listed below each entry

Buy Custom Answer of This Assessment & Raise Your Grades

- CH2123 Assignment: Fugacity, VLE Modeling & Applications of Henry’s Law

- BAFI1045 Assignment -Constructing and Evaluating Passive and Active Portfolios Based on the Straits Times Index (STI)

- FIN2210E/FIN2212E Group Assignment: Financial Risk Management Analysis of Bursa Malaysia Companies

- FLM101 Assignment: A Film Analysis: Stylistic Techniques and Their Thematic Importance

- HRM Assignment Answer: Talent Transformation in the Age of AI: Turning Challenges into Opportunities via Ecosystem Innovation

- COMP 1105 Assignment: Health-Focused E-Commerce Website: A Web Technologies Project Using HTML5, CSS, and JavaScript

- Assignment Anwser: Machine Learning in Robo-Advisory Services: Evolution, Applications, and Future Trends

- OMGT2229 Assignment: Quantitative EOQ Analysis, and Strategic Sourcing Decisions for JB Hi-Fi

- Assignment 2 Anwser: Corporate Finance and Planning: An In-Depth Financial Analysis of Company

- BUSM4551 Assignment: The Role of Innovation in Advancing the UN Sustainable Development Goals (SDGs)

UP TO 15 % DISCOUNT