BUS356 Group Assignment: Contemporary Financial Accounting

| University | Singapore University of Social Science (SUSS) |

| Subject | Business Negotiation |

Group Assignment Question

The assignment must be submitted online through the LMS under the Group Assignment section by the deadline. Ensure that only one member of the group submits the final assignment on behalf of the group. The group assignment is to be done in pairs of TWO or Three students

from the same face-to-face class. Students are required to find their own partners, to complete the assignment with and are not permitted to partner with a student from a different class. External students can either do the assignment on their own or with another external student.

Late submissions will not be accepted, and no extensions will be granted. Students are reminded that assignments are to be their own work. Any evidence of collusion or plagiarism between groups will be treated as academic misconduct, and appropriate action will be taken. The assignment will be marked on its merit rather than on the correctness of the solution.

Students are encouraged to do their best and to use the assignment as a learning tool for the online quizzes and final exams.

Please find the instructions for the individual assignment over the page.

You are required to submit your assignment as a Word file using size 12, Times New Roman font.

There is a word limit on the written answers to questions 4 & 5 of the assignment; your answers for these questions are not to exceed 750 words for both answers. It is recommended that you reference your answers where appropriate.

Generative AI

While students are permitted to used generative AI to enhance their understanding of contemporary financial accounting concepts and principles, generative AI must be properly referenced if it is used in this assessment. If evidence of the use of generative AI is found in this assignment without proper referring, academic misconduct proceedings will be initiated.

Group Assignment Question

Question

On 1 July 2019, Diana Ltd acquired 100% of the issued shares of Charles Ltd for $320 000. At the date of acquisition, the shareholders’ equity of Charles Ltd consisted of:

$

Share capital 200 000

General reserve 50 000

Retained earnings 30 000

280 000

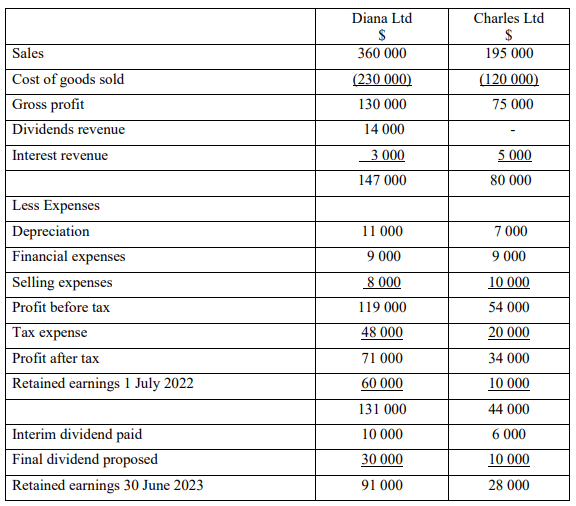

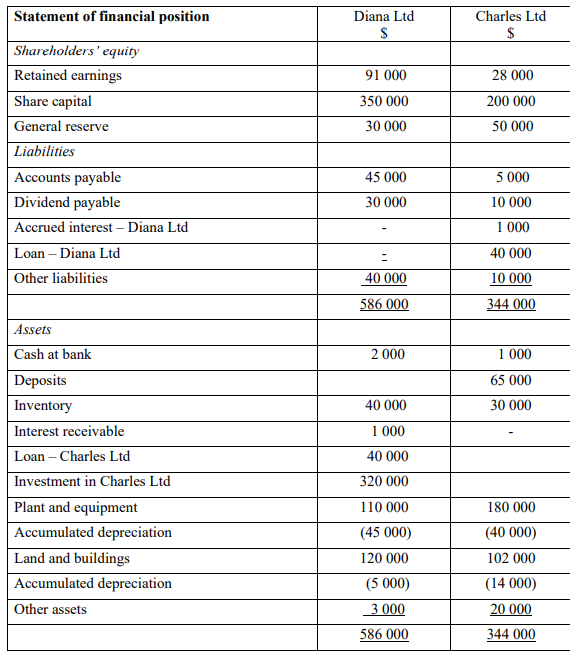

At 30 June 2023, the accounts of the two companies are presented below.

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Additional information:

• The identifiable net assets of Charles ltd were recorded at fair value at the date of acquisition.

• In applying the impairment test for goodwill in the current year, the directors have determined that a write-down of $10 000 is required for consolidation purposes. The cumulative goodwill impairment write-downs for prior years amounted to $15 000.

• An item of plant and equipment owned by Charles (cost $30 000 and accumulated depreciation of $15 000) was sold to Diana Ltd for $13 000 on 1 July 2020. Charles depreciated the asset at 10% per annum straight-line on original cost (assuming a 10-year economic life). Diana, assuming a further economic life for the plant and equipment five years from its date of acquisition, has applied a depreciation rate of 20% straight-line from the date of transfer of the asset.

• The opening inventory of Charles Ltd includes unrealised profit of $2 000 on inventory transferred from Diana Ltd during the prior financial year. All of this inventory was sold by Charles Ltd to parties external to the group during the year ended 30 June 2023.

• During the current financial year, Charles Ltd purchased inventory from Diana Ltd for $30 000. The inventory had previously cost Diana Ltd $24 000. One-third of this inventory was sold to outsiders by Charles during the year.

• Charles Ltd borrowed $40 000 from Diana Ltd during the financial year. Charles paid $2 000 interest on this loan during the year. In addition, a further $1 000 in interest has been recognised as an accrued expense in Charles Ltd’s accounts and as interest receivable in Diana Ltd’s accounts. Interest expense is included in Charles Ltd’s accounts under the financial expenses heading.

• On 15 July 2022, Charles Ltd paid a final dividend of $8 000 to Diana Ltd from profits for the prior financial year.

• Charles also paid an interim dividend of $6 000 to Diana Ltd on 1 February 2023. In addition, Charles Ltd has provided for a final dividend amounting to $10 000. Diana Ltd has not recognised this dividend as a receivable prior to receipt.

• The tax rate is 30%.

Required

1. Prepare an acquisition analysis.

2. Prepare the consolidation journal entries necessary to prepare consolidated accounts for the year ending 30 June 2023 for the group comprising Diana Ltd and Charles Ltd.

3. Prepare the consolidation worksheet for the preparation of the consolidated financial statements for the period ended 30 June 2023.

4. Why is it important to identify intragroup transactions as current or previous period transactions?

5. In what circumstances is a tax-effect adjustment required when making an adjustment for an intragroup transaction? Provide two examples of intragroup transactions that would require a tax-effect adjustment and one example of an intragroup transaction that would not require a tax-effect adjustment.

Buy Custom Answer of This Assessment & Raise Your Grades

- ECE316 ECA: Classroom Inquiry and Action Research: A Research-Based Assessment

- BPM115 TMA02: Sustainable Materials Feasibility Study for a Cross-Country Bridge

- BSC203 Assignment: Project Management Portfolio: Key Deliverables and Lessons Learned

- SOC367 ECA: Impact on Gender Equality in the Philippines and Southeast Asia

- HBC251 ECA: Religion in Contemporary Societies Semester 2025 SUSS

- HRM335 ECA: Analysis of Thought Leadership: Influence, Impact, and Competency Framework

- HBC101 TMA01: Understanding Contemporary Society: The Social and Behavioural Sciences

- HRM358 ECA: Diversity and Inclusion in the Workplace Semester 2025

- BUS357 ECA: Starting and Managing a Business Semester 2025

- FLM201 TMA01–02: Film Genre: Understanding Types of Film: Marketing, Love, and Trauma

UP TO 15 % DISCOUNT