| University | Singapore University of Social Science (SUSS) |

| Subject | FIN358 Fixed Income And Derivative Securities Assignment |

FIN358 Fixed Income And Derivative Securities Assignment, SUSS, Singapore: In each of the questions below the first option is priced correctly. Indicate how the second option

Question 1

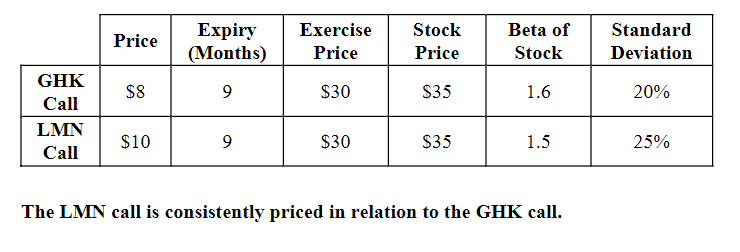

In each of the questions below the first option is priced correctly. Indicate how the second option should be priced in relation to the first call.

Question 1a

Appraise whether the statement regarding the pricing of the LMN call is true, false, or cannot be decided, and give reasons for your choice.

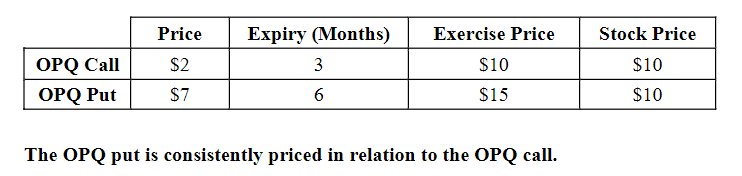

Question 1b

Appraise whether the statement regarding the pricing of the OPQ put is true, false, or cannot be decided, and give reasons for your choice.

Question 2

“The Federal Reserve will likely need to raise interest rates more than expected in response to recent strong data and is prepared to move in larger steps if the “totality” of incoming information suggests tougher measures are needed to control inflation, Fed Chair Jerome Powell told U.S. lawmakers on Tuesday.” (Reuters, 7 March 2023) “President Biden proposed a $6.9 trillion budget that calls for reducing deficits and raising taxes on wealthy people and large corporations, detailing a policy vision that isn’t expected to gain momentum in Congress, but is an opening salvo in spending talks with Republicans.” (Wall Street Journal, 10 March 2023)

Two bond portfolio managers, Tom and Jerry, were discussing the reports.

Tom: If the Fed were to raise interest rates, this would curtail corporate and individual spending as borrowing costs increase. As a result, the economy will slow down and the Fed may have to cut interest rates to prevent a hard landing. Further, given the Republican control of the House of Representatives, it is unlikely that Biden’s proposal to increase tax rates will be accepted. My view is that interest rates are likely to fall by 150 basis points in the next 1 year.

Jerry: Biden’s plan to reduce deficits is just a dream. In fact, the government deficit will increase. I agree with you that an increase in tax rates is very unlikely. So, to fund all the proposed spending, the government will have to come to the market to borrow more, causing a rise in interest rates. My view is that interest rates are likely to rise by 150 basis points in the next 1 year.

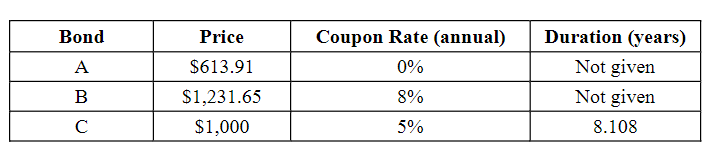

The two portfolio managers have been presented with a list of bonds, which all have the same credit rating, time to maturity, and par value of $1,000, to invest:

The details of the bonds are as follows:

Hire a Professional Essay & Assignment Writer for completing your Academic Assessments

Question 2a

Based on his view expressed above, if Tom wants to maximize the total return of his portfolio, appraise which bond, if any, he should buy. (Word limit: 150 words)

Question 2b

Based on his view expressed above, if Jerry wants to increase the total return of his portfolio, appraise which bond, if any, he should buy. (Word limit: 150 words)

Question 3a

Based on the binomial tree below which is based on a 7% coupon bond with 10% interest rate volatility, illustrate the steps you would use to derive the value of the bond at time 0 and compute the value.

Question 3b

Suppose the bond is callable at a call price of 100.5 from year 1. Compute the value of the callable bond at time 0.

Question 3c

Compute the value of the callable bond’s embedded call option. Appraise how the value of the option would change if interest rate volatility increases (no computation required).

Question 4

You are the risk manager of a bond fund. The top management of the fund is concerned about the risks facing the fund. Present to the management any 2 concepts, formulas, or measures that you learned in this course that could help in hedging the risks.

Section B (25 marks)

Answer all questions in this section.

Question 5

Based on Question 4, prepare a video recording of the presentation of at least 3 minutes but not exceeding 6 minutes. There are two methods for ECA video assignment submission; either Record LIVE or Upload Media. For Upload Media, please note that your file size should be no more than 500MB and the format is in .mp4.

(25 marks)

Section C (10 marks)

Answer all questions in this section.

Question 6

Prepare a set of PowerPoint presentations upon which the video presentation is based. Please note that the PowerPoint must be converted to PDF before submission to Canvas.

Buy Custom Answer of This Assessment & Raise Your Grades

Looking for assignment help in Singapore? At the Singapore University of Social Science (SUSS), students facing challenges with FIN358 Fixed Income And Derivative Securities Assignment can now turn to our expert team for top-notch TMA and individual assignment assistance. Our Essay Writing Services cater to the academic needs of SUSS students, providing professional support in navigating complex assignments. With us, Singapore students can pay for expert guidance on their coursework. Don't struggle alone; let us help you excel in your studies.

- A2329C Dosage Form Design AY2024 Term 4 – Graded Assignment (Individual Report), Singapore

- ANL312 Text Mining and Applied Project Formulation, End-of-Course Assessment, SUSS, Singapore

- CMM315 Peacebuilding and Security, End-of-Course Assessment, SUSS, Singapore

- HFS351 ECA (End-of-Course Assessment) SUSS : July Semester 2024 – Safety Management and Audit

- HFSY217 ECA (End-of-Course Assessment) SUSS : July Semester 2024 – Emergency Preparedness and Response Planning, Singapore

- NSG3EPN Assignment Two instructions rubric – Contemporary nursing practice :Engagement in Professional Nursing, LTU Singapore

- HFS201 GBA (Group-based Assignment) SUSS: July 2024 – Workplace Evaluation and Design

- Business Accounting & Finance – (VM) – A3 Assignment, UOM, Singapore

- HRM3010S: Managing People At Work, Assignment, UCD, Singapore

- HFS351: Safety Management and Audit, End-of-Course Assessment, SUSS, Singapore

UP TO 15 % DISCOUNT